Tiara Wallace not too long ago accepted her position because the Director of Danger for Invesco US and might’t appear to cover her contagious pleasure for her occupation. After saying in a latest interview with Triple-I that she is a brand new “canine mother,” she proudly revealed that she is a father or mother to a 20-year-old “who’s in faculty and not too long ago switched his main to threat administration.”

She had defined to her son how some actions in his present (however unrelated) campus job, resembling “reviewing contracts and figuring out if the enchantment course of is working,” could possibly be a superb basis for a future position within the discipline.

Wallace’s advocacy for careers in threat administration doesn’t cease together with her household. Having spent a while as an adjunct professor on the College of Oklahoma, she delights in steadily sharing with younger folks the advantages and alternatives they could discover in her occupation. She tells them that “insurance coverage and threat administration is such an important and profitable profession,” welcoming folks from numerous backgrounds.

“Some people have faculty, some folks simply have expertise within the business. However you’re in a position to make it into no matter you want on your life. And there’s so many routes you may go down.”

She launched her journey by working in claims adjustment for ten years. Then she determined it was time for a change. “Do I pivot now and make the develop into one thing else?” she requested herself.

A buddy remarked on her expertise for educating folks and understanding what drives claims. “Have you ever ever thought of security or threat administration?” her buddy requested.

Wallace says a threat administration main wasn’t out there to her as an undergraduate. “So I did what any typical millennial does and I bought on the Web and began to lookup jobs.”

She was shocked to find she was already aware of the foundations. She thought, “That is what all of us do day-to-day, proper – managing our selections and figuring out the place our threat urge for food is?

She offers ample credit score to her mentor, who has since change into a household buddy, for giving her a transformational alternative. “He was the VP of Danger for a privately held financial institution in Oklahoma,” she says. He employed her as the chance supervisor for a household group of 20 ultra-high-net-worth people.

The job suited her properly. “It was by no means mundane…and that basically spoke to me and actually began the journey into threat administration for me.”

Years later, Wallace ultimately relocated to Dallas and is now in her position working with business actual property and personal fairness at Invesco. The information and abilities she acquired working with the non-public agency are serving to her excel in a publicly traded firm, the place she continues to develop.

“I’m studying a ton, and there’s lots coming at me, however I benefit from the problem.”

When requested what adjustments she’s witnessed in her discipline over time concerning variety, Wallace is candid, pragmatic, and hopeful.

“Going from a name heart and claims the place you see all varieties of folks to those areas the place it’s on the business aspect, and I’m going to totally different conferences. Typically, you may see the identical kind of individual that fills the position.”

Wallace describes her firsthand account of a difficulty that’s broadly documented by numerous organizations – from the Bureau of Labor Statistics (BLS) to key gamers within the threat administration discipline, resembling Marsh.

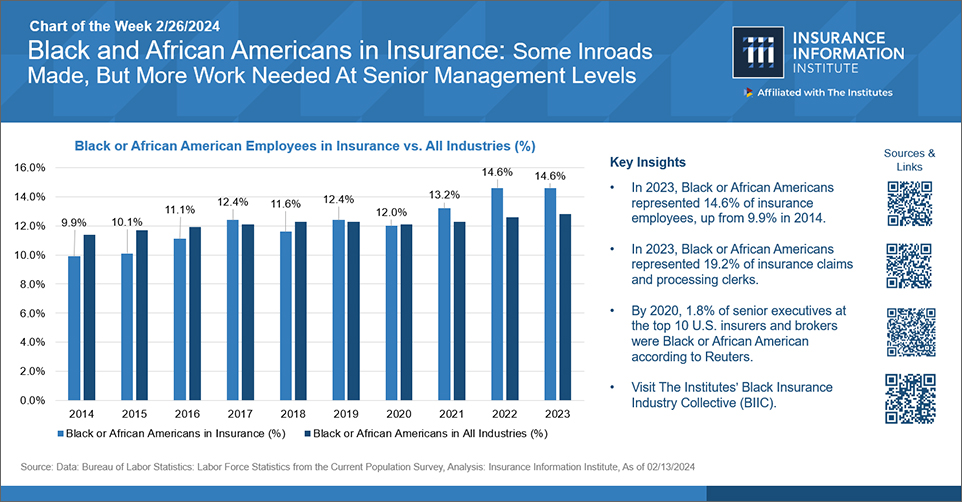

For instance, BLS knowledge on Black and African American illustration within the insurance coverage business exhibits that illustration is growing, with 14.6% workers within the discipline, up from 9.9% in 2014. Black professionals held 19.2% of insurance coverage claims and processing clerk roles. Nonetheless, as of 2020, only one.8% (simply three out of 168) of government workers within the business are Black, in accordance with knowledge sourced by Reuters

“Within the final three or 4 years, I feel what I’ve started to see, simply from the totally different generations getting into in, is there’s a extra of a push for that variety,” Wallace says. She notes that the range sought is just not solely in race, ethnicity, gender, and different identities but additionally in neurodiversity {and professional} backgrounds.

“I feel that we nonetheless have an extended solution to go. However we’re beginning to see extra the place the conclusion is, hey, we’d like a various candidate pool as a result of right here within the subsequent what, 5 to 10 years, we’re gonna have an exodus on this market.”

Wallace admits that, as a long-standing business, insurance coverage can take a while to catch up whereas know-how, demographics, and different structural elements are quickly altering the sport for your entire economic system.

“We’ve not historically, and we’re nonetheless at the moment, not at all times fast to leap on pondering proactively or shifting ahead.” Nonetheless, Wallace says she is taking an energetic position in creating the long run she desires to see.

“And so I feel the factor that I began to comprehend is… I’m gonna be a part of this alteration. So let me become involved in organizations.” Her academic expertise doubtless performed a task on this outlook.

She remembers how her faculty enterprise fraternity chief requested her to “Go discover three those that seem like you. And three folks that don’t look or come from the place you come from and recruit them.”

Wallace took up the problem, in fact. “That was some of the phenomenal years as a result of I bought to be taught a lot. So I introduced that mindset into this business,” she says.

When Wallace was finding out for her grasp’s diploma years in the past, a professor inspired the category to be “brokers of social change, like go in and be a disruptor.”

Now, when she advises folks on connecting with numerous prospects, she asks whether or not they’re looking out past their private networks and conventional areas. “Are you going to HBCUs (Traditionally Black Faculties and Universities)? Are you going to totally different candidate swimming pools? Are you going to rural cities and cities the place perhaps folks haven’t traditionally gone into? Are you additionally speaking to veterans?”

Wallace additionally acknowledges that the work atmosphere will likely be as crucial to variety success as recruiting techniques. For instance, she asks, “Are our areas pleasant and welcoming to those who perhaps have disabilities?”

She encourages aspiring professionals to assume past the cliche of an insurance coverage job to see the place they might match. “Are you good at advertising? As a result of these insurance coverage corporations want advertising departments. Are you useful on the Web? Oh, properly, nice. There’s a spot in cyber or additionally IT (Data Know-how) infrastructure.” The aim, she says, is “simply having these conversations to get totally different folks into this house…within the business.”

“A few of you’re gonna be strategic, too, you realize, to implant yourselves in areas that historically haven’t allowed you to enter.”

Wallace says she would inform her youthful self that being bolder and assertive in asking for what she wants will likely be essential.

“As a girl, you higher have the ability to promote your self and brag on your self and never and never take a step again and simply assume that’s what everyone seems to be doing. Make the ask as a result of you may get paid for what it’s. However you must be daring sufficient — whether or not that’s a sale, whether or not that’s a wage, whether or not that’s you want staffing in your division, otherwise you need assistance. Make the ask as a result of you’re the one that’s in there working it daily.”