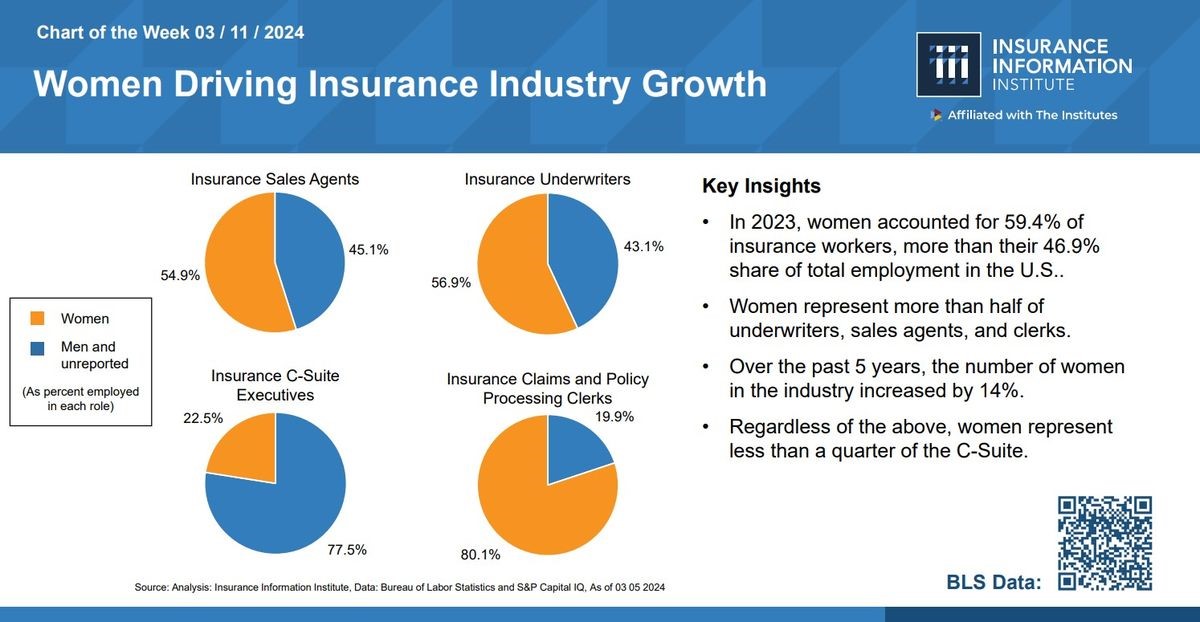

The insurance coverage trade is on monitor for continued development, with ladies enjoying an enormous half, however gender fairness on the high stays a great distance off. Bureau of Labor Statistics (BLS) information exhibits the expertise pipeline isn’t a problem, as ladies account for 59.4 % of the insurance coverage workforce. They comprise 80.1 % of staff serving as claims and coverage processing clerks, 54.9 % in gross sales roles, and 56.9 % of underwriters. But, solely about 22 % (lower than 1 in 4) of staff within the C-Suite are ladies.

Regardless of the setbacks of the early pandemic years, wherein ladies shouldered the brunt of associated workforce losses, ladies have made up roughly 60 % of the insurance coverage workforce every year since 2012, exceeding their share of complete employment within the U.S. (46.9 %).

Personal sector analysis provides extra particulars to this stark image. A Marsh research carried out in 2022 revealed that “25 out of 27 (92.5 %) of the biggest insurance coverage firms had been led by males.” Equally, a McKinsey research confirmed, “white ladies make up 45 % of entry-level roles but…fewer than one in 5 direct experiences to the CEO are ladies.” Gender disparities additionally seem to extend throughout race and ethnicity.

A latest research from Liberty Mutual and Safeco Insurance coverage exhibits that the variety of ladies homeowners or principals in insurance coverage businesses decreased from 31 % to 26 % between 2022 and 2023. In distinction, ladies comprise 75 % of customer-facing workers in these organizations.

S&P International Analysis evaluation findings counsel “ladies may attain parity in senior management positions between 2030 and 2037, amongst firms within the Russell 3000.” Whether or not that may play out eventually for insurance coverage isn’t clear. The August 2023 report additionally reveals that the “majority of progress in the direction of gender parity is coming from ladies taking seats on firm boards.” Nonetheless, C-suite management throughout all industries might not present full gender parity till the 2050s, and “the best ranges in CEO and CFO positions may take even longer.”

Gender parity can supply options for a wholesome monetary future

In the meantime, the trade expects to face huge attrition as hundreds of staff (together with their management abilities and data) finally exit the workforce within the coming years. Automation and synthetic intelligence/machine studying (AI/ML) might remove the necessity for some roles. Nonetheless, insurers will undoubtedly want to keep up an ecosystem of effectivity and innovation to stay worthwhile. Elevated implementation of data-driven processes and decision-making brings new moral implications and regulatory obligations.

Organizational variety is usually outlined as individuals from a wide range of backgrounds and views working collectively to unravel enterprise issues. Strategic long-term success requires figuring out, growing, and selling numerous expertise in any respect ranges. Nevertheless, an absence of variety on the C-suite stage can undermine probably the most valiant recruitment efforts in different elements of the group. At this time’s pushed and career-focused candidates are cautious of glass ceilings and might want proof that inclusion and fairness come from the highest.

Analysis has indicated ladies in management can positively influence the organizations they run. After a collection of 4 research over a number of years, findings from McKinsey point out that “management variety can be convincingly related to holistic development ambitions, higher social influence, and extra happy workforces.” Additional, the newest research additionally notes the “enterprise case for gender variety on government groups has greater than doubled over the previous decade.” Different analysis signifies that, amongst U.S. property-casualty insurance coverage firms, feminine CEOs are related to “decrease insurer insolvency propensity, larger z-score, and decrease normal deviation of return on belongings.”

Within the period of the nation’s first feminine vice-president, finally, company boards would possibly discover that reflecting the market demographics the savviest and most compelling of all causes to diversify senior management. Collectively, U.S. millennials and the oldest Gen Zers (already taking over grownup obligations) command almost $3 trillion in spending energy every year. Each generations have duly ready themselves to advance within the workforce, changing into extra educated than earlier generations. And they’ll little doubt seize a possibility the place they will discover it.