Insurance coverage affordability in Georgia is dwindling as declare frequency and insurer prices soar, based on the newest problem temporary from Insurance coverage Info Institute (Triple-I), Developments and Insights: Georgia Insurance coverage Affordability.

Given the state’s below-average earnings vs. above-average insurance coverage expenditures, Georgia ranks forty second on the checklist of inexpensive states for owners insurance coverage and forty seventh (plummeting from the 2006 excessive of twenty seventh) for private auto affordability, based on studies by the Insurance coverage Analysis Council. This temporary offers an outline of how a number of elements, together with skyrocketing prices from litigation, pose dangers to protection affordability, availability, and different potential financial outcomes for Georgia residents. Tort reform is mentioned as a legislative answer to the problem of authorized system abuse – extreme policyholder or plaintiff legal professional practices that enhance prices and time to settle insurance coverage claims.

The Georgia insurance coverage market grapples with a number of danger elements

From 1980–2024, Georgia was impacted by 134 confirmed climate/local weather catastrophe occasions by which losses exceeded $1 billion every. A minimum of 38 of these occasions occurred within the final 5 years, with 14 in 2023. Householders in Georgia’s most climate-risk-vulnerable counties, such because the coastal and most southern components of the state, can face double-digit premium hikes or nonrenewals. Additionally, information signifies the speed of underinsured motorists in Georgia is twice as excessive because the nationwide common, and the speed of uninsured motorists is 25 p.c greater. Harm declare severity within the state is barely greater than in the remainder of the nation.

Information signifies that litigation prices have develop into a pervasive concern for danger administration.

Rising declare frequency and litigation prices put protection affordability and availability in danger. For instance, the IRC findings throughout private auto strains present a twin development in Georgia of elevated claims and litigation. Property injury legal responsibility claims per 100 insured automobiles are 15 p.c greater, and relative physique damage claims frequency is 60 p.c greater. In accordance with IRC, the speed for personal passenger litigation in Georgia is sort of thrice that within the median state.

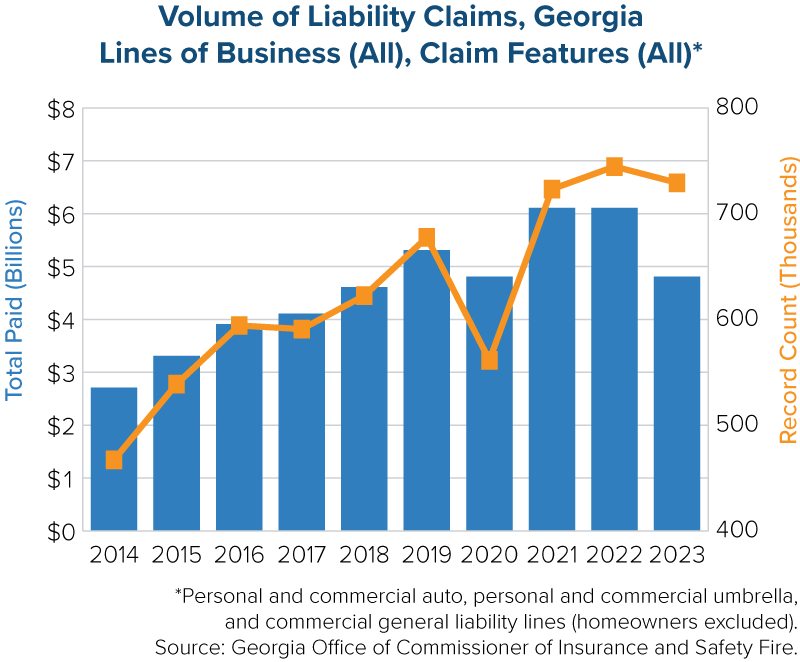

The Georgia Workplace of Commissioner of Insurance coverage and Security Hearth (“OCI”) reviewed all strains throughout private and industrial auto, private and industrial umbrella, and industrial normal legal responsibility (owners legal responsibility was excluded). The five-year common rely for legal responsibility claims elevated 24.9 p.c (2014 – 2018 at 583,756 vs. 2019-2023 at 729,191). A rising proportion of claims with cost are full-limit claims, and the OCI evaluation signifies litigation is driving that enhance. Whereas prices rose for each litigated and non-litigated claims, the variety of claims with authorized involvement dominated paid indemnity for many strains of enterprise, and litigated claims comprised a rising portion of the overall paid indemnity.

Attorneys seem to have revved up their mining for lawsuits in Georgia. Legislation companies spent $160 million on promoting in Georgia, based on preliminary information from the American Tort Reform Affiliation (ATRA). Outside advertisements for lawsuits elevated by 119 p.c in GA throughout that point. It won’t be a shock then to see that the Georgia OCI report exhibits authorized (legal professional concerned) claims dominated Private Auto claims for Bodily Harm, comprising 62 p.c of claims and 86 p.c of whole indemnity paid for closed claims in Accident Yr 2023. A overview of losses of $1 million or extra accidentally 12 months which have closed throughout the 2014 to 2023 interval exhibits that every accident 12 months cohort surpasses the rely from the earlier accident years.

Not too long ago launched state tort reform laws could assist to stabilize insurance coverage prices.

Analysts estimate that litigation prices Georgia residents $880 million yearly, or a mean of $1,415 per resident. Sean Kevelighan, Triple-I CEO, says “understanding how these traits drive up prices and figuring out coverage levers for tort reform laws can in the end deliver optimistic outcomes for Georgia’s economic system and its shoppers and enterprise house owners.”

As a part of our dedication to educating stakeholders, Triple-I has launched a multi-faceted marketing campaign to boost consciousness of the mounting prices of authorized system abuse in Georgia and different states. We invite you to view the video assertion by our CEO Sean Kevelighan, interviews capturing the opinions of shoppers about authorized system abuse, and skim the complete problem temporary, Developments and Insights: Georgia Insurance coverage Affordability.