Householders insurance coverage premium progress in Florida has slowed for the reason that state applied authorized system abuse reforms in 2022, in keeping with a Triple-I evaluation.

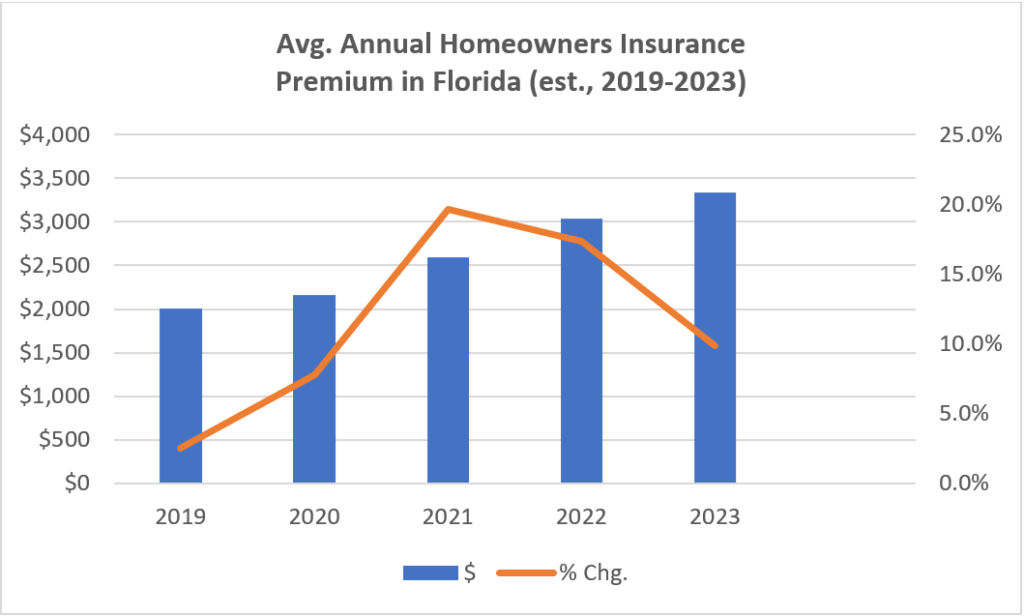

As proven within the chart under, common annual premiums climbed sharply after 2020. This was due partly to inflation spurred by the COVID-19 pandemic and the warfare in Ukraine in addition to longtime challenges within the state with declare fraud and authorized system abuse. In accordance with the state’s Workplace of Insurance coverage Regulation (OIR), Florida accounted for almost 71% of the nation’s householders claim-related litigation, regardless of representing solely 15% of householders claims in 2022, the 12 months Class 4 Hurricane Ian struck the state. In that very same 12 months, and previous to Ian making landfall within the state as a primary main hurricane since 2018’s Hurricane Michael, six insurers declared insolvency. Hurricane Ian turned the second largest on report by insured losses, largely due to the extraordinary litigation prices estimated to lead to Florida within the aftermath.

Supply: Triple-I evaluation of NAIC and OIR knowledge

The Florida Legislature responded to the rising disaster by passing a number of items of insurance coverage reform, primarily tackling issues with project of advantages (AOB), bad-faith claims, and extreme charges. For instance, the brand new legal guidelines eradicated one-way lawyer charges in property insurance coverage litigation, forbid utilizing appraisal awards to file a bad-faith lawsuit, and prohibited third events from taking AOBs for any property claims. The laws additionally ensures transparency and effectivity within the claims course of and encourages extra environment friendly, less expensive options to litigation.

A surge in litigation

Litigation spiked when backlogged courts reopened following the pandemic, then once more when the reforms had been handed in 2022 and 2023, as plaintiffs’ attorneys raced to file fits forward of implementation of the laws.

This improve in litigation, mixed with persistently robust inflation, contributed to elevated loss prices and premium will increase. In 2022, common householders premium charges rose greater than 17 %, to $3,040. Premiums continued to rise in 2023, though at a reducing fee, as inflation has moderated and authorized reforms have kicked in.

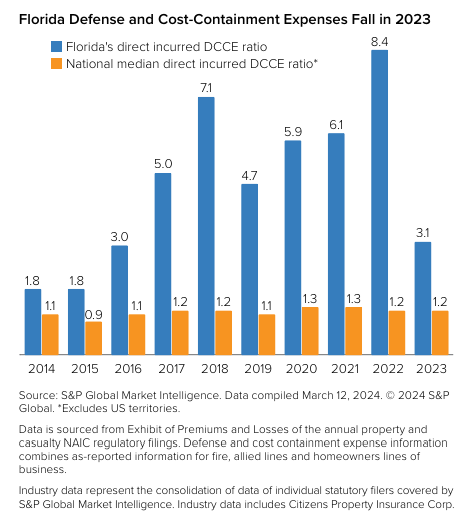

There are early indicators that the reforms are starting to bear fruit. In 2023, Florida’s protection and cost-containment expense (DCCE) ratio – a key measure of the impression of litigation – fell to three.1, from 8.4 in 2022, in keeping with S&P World. In greenback phrases, 2023 noticed $739 million in direct incurred authorized protection bills – a significant decline from 2022’s $1.6 billion. For perspective, incurred protection prices within the two largest U.S. insurance coverage markets in 2023 had been $401.6 million in California, adopted by $284.7 million in Texas. Because the chart under reveals, Florida’s DCCE ratio – even throughout its greatest years – often exceeds the nation’s.

As insurers have failed or left the state, Residents Property Insurance coverage Corp. – the state-run insurer of final resort and at present Florida’s largest residential insurance coverage author – has swelled with new enterprise and lawsuits. Residents’ depopulation efforts to maneuver policyholders to personal insurers contributed to coverage counts falling to 1.23 million by the tip of 2023.

It’s essential to keep in mind that all premium estimates are based mostly on the perfect info out there on the time and precise outcomes might differ as a result of modifications in market circumstances. For instance, earlier Triple-I projections that common annual householders premiums in Florida would exceed $4,300 in 2022 and $6,000 in 2023 assumed important fee will increase could be wanted to revive profitability to the state’s householders market. These projections didn’t assume legislative reform or that Residents would turn into the state’s largest householders insurance coverage firm, with many dangers priced under the admitted and extra and surplus markets. Our projections additionally assumed inflation would proceed to develop at charges much like these prevailing on the time.

In mild of the reforms and moderating inflation, we are actually reporting decrease common annual premiums of $3,040 (2022) and $3,340 (2023). The Florida OIR has reported common premium fee filings are working under 2.0 % in 2024 year-to-date within the non-public market. Additional, OIR indicated eight home carriers have filed for fee decreases and 10 have filed for no improve this 12 months. Moreover, eight property insurers have been authorised to enter the Florida market, with extra anticipated this 12 months.

Triple-I’ll proceed to observe and report on the enhancing property insurance coverage market in Florida.