By Neil Rekhi, Private Cyber Product Lead, HSB

Concentrating on of the demographic with probably the most to lose will increase.

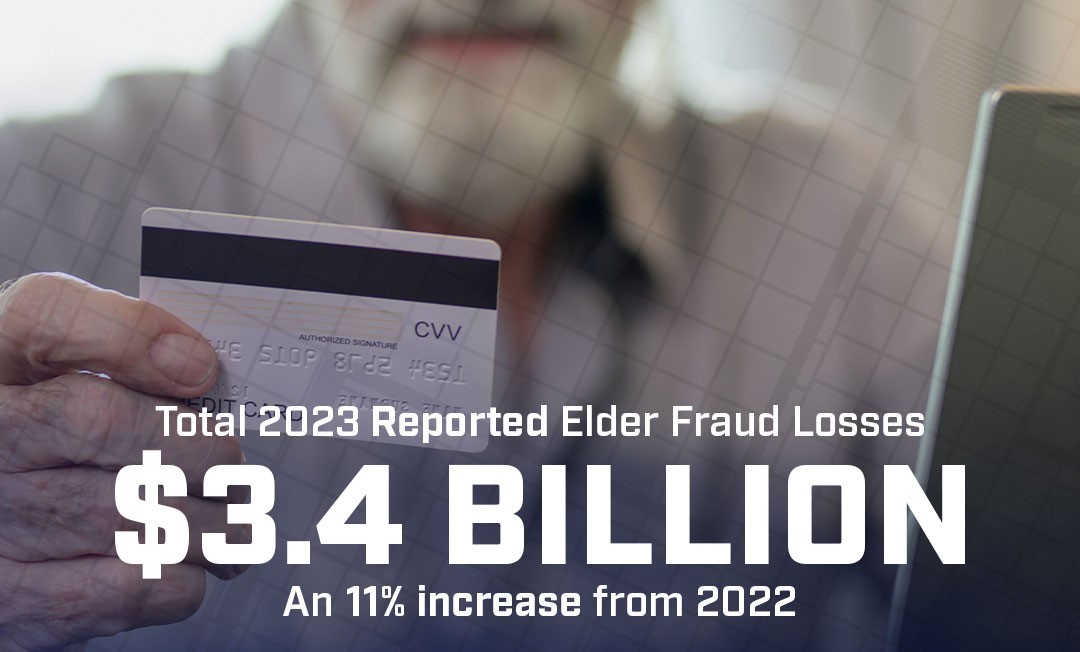

In 2023, complete losses reported to the FBI’s Web Crime Grievance Middle (IC3) by folks over the age of 60 topped $3.4 billion, an nearly 11 % improve in reported losses from 2022. The variety of complaints, the best attributed to a single age group, elevated by 14 %. The typical greenback loss per criticism was $33,915, with almost 6,000 folks shedding over $100,000 per declare.

The IC3 report outlined a number of widespread cyber fraud actions that impression people over 60, together with:

- Name Middle/Tech Assist Rip-off

- Confidence/Romance Scams

- Cryptocurrency Scams

- Funding Scams

The IC3 notes the precise figures round these and different cyber crimes concentrating on the aged could also be larger since solely about half of the greater than 880,000 complete complaints it acquired (with complete losses exceeding $12.5 billion) included age knowledge.

A serious cause for the proliferation of elder fraud could merely be that members of this age group are plentiful whereas additionally having comparatively probably the most to steal. Adults 65 and up are anticipated to make up 22 % of the US inhabitants by 2024. Federal Reserve knowledge signifies that their asset accumulation outpaces that of different age teams, with median and common web price figures for adults 65-74 at $409,900 and $1.8 million, respectively, and for adults 75 and over, $335,600 and $1.6 million respectively.

Growing digital lives and advancing know-how create new threats.

The transition to the good cellular and app economic system, together with the rise of huge knowledge and predictive analytics/AI, and (as a result of pandemic) distant working, have remodeled the best way we have interaction with the world on a social, skilled, and monetary stage. The Web of Issues (IoT) and every individual’s increasing community of private units — good TVs, online game consoles, home equipment, residence local weather management methods, and so on. — have propelled the digitization of our existence. All these developments could make life simpler but additionally improve factors of cybersecurity vulnerability for folks of all ages.

Nonetheless, knowledge signifies that totally different age teams will be inclined to totally different strategies of concentrating on by cyber scammers. For instance, phishing, which depends on the human tendency to repay what one other individual has supplied, will be more practical for concentrating on older vs youthful adults. Additionally, immediately’s client underneath age 25 could by no means have the necessity to write a paper examine, however many over 65 immediately have spent a good portion of their lives dealing with their monetary affairs that method. Thus, the belief positioned in tech assist folks and different personnel whom they’re presupposed to depend on for help is comprehensible.

Sadly, in accordance with the IC3, folks over 60 misplaced extra to name heart and tech assist scams than all different age teams mixed, with this group reporting 40% of those incidents and 58% of the associated monetary losses (about $770 million). Widespread schemes concerned utilizing telephone calls, texts, emails, or pop-up home windows (or a mix of those) to attach with victims, manipulating them to obtain malicious software program, reveal non-public account info, or switch property. The fallout included remortgaged houses, emptied retirement accounts, and, in some instances, suicide.

New instruments and strategies improve cyber safety threats.

A monetary providers skilled at a Hong Kong-based agency despatched US$25 million to fraudsters after she believed she was instructed to take action by her chief monetary officer on a video name that additionally included different colleagues. Deepfakes, one in all 2024’s more and more widespread cyber dangers for companies and organizations, is on monitor to develop into a serious menace to private cyber legal responsibility. A know-how referred to as “deep” studying (therefore the identify) can generate photos, movies, texts, or sound information particularly designed to be extremely convincing regardless of being completely made up.

This content material can flip up anyplace on social media, the web, and even in emails and telephone calls, fooling unsuspecting people, and, all too usually, even detection software program. Deepfakes aren’t all the time produced for malicious actions; some are used broadly for leisure. Nonetheless, the rising sophistication of deepfakes and the supply of the know-how wanted to make it might have critical implications for cyber danger.

Cyber criminals can leverage this know-how to trick victims into divulging delicate info, transferring cash, or performing different actions. Reputations will be broken by fabricated photos of victims engaged in unlawful or controversial acts. The sort of deep faux also can allow blackmail in trade for not releasing the fabric. Along with impersonating people, cyber criminals can use deep fakes to bypass biometric verification or create false promoting.

The choices for managing private cyber danger can differ in essential methods.

Personally identifiable info (PII) is the first driver of identification theft and most different cyber fraud. Main knowledge breaches have gotten widespread place, such because the incident that occurred in 2023 (however wasn’t reported till August 2024) that credit score uncovered 2.7 billion information. Dangerous actors exploit this type of info to immediately have interaction in fraudulent transactions or create belief with their targets in additional advanced schemes.

Because of heavy advertising and marketing and huge availability from banks and card issuers, shoppers are typically acquainted with Id Theft Safety (ITP). Because the identify implies, such plans revolve across the danger of stolen identification and may alleviate a few of the work and prices associated to monitoring and mitigating the fallout from identification theft.

In distinction, Private Cyber Insurance coverage (PCI) gives protection for a broader vary of losses. Coated dangers, along with ITP, can embody cyber extortion, on-line fraud and misleading transfers, knowledge breaches, cyberbullying, and extra. An vital facet of PCI is that it may possibly assist present monetary reimbursment from coated “cyber scams” or associated social engineering danger circuitously tied to identification theft, cyber crimes that are on the rise. It additionally gives help and monetary reimbursment for compromised units. For instance, if a policyholder is hacked, private cyber insurance coverage could assist cowl the prices of hiring an expert to reformat the arduous drive, reinstall the working system, and restore knowledge from the backup.

“Social engineering and different cyber-related threats in opposition to shoppers proceed to develop and evolve, and insurance coverage carriers are providing inexpensive private cyber protection that may be simply added to a owners or renters insurance coverage coverage,” says James Hajjar, Chief Product Officer at Hartford Steam Boiler (HSB).

HSB, which has been providing private cyber insurance coverage since 2015, has developed its protection a number of occasions over time to remain forward of cyber danger developments and the dynamic menace panorama. Given the growing complexity of cyber dangers and the rise of subtle scams — comparable to phishing and ransomware — that sort of safety shouldn’t be restricted to identification theft. Strong PCI protection safeguards in opposition to a variety of different cyber-related points and gives crucial assist to make sure policyholders aren’t left to cope with the monetary aftermath of a cyber incident alone.

“It’s essential that cyber insurance coverage is particularly designed to assist people defend themselves in opposition to these evolving threats and gives monetary safety and extra packages and providers if somebody is hacked,” Hajjar says.

Traditionally, ITP has been broadly provided by way of banks, credit score unions, bank card issuers, and credit score reporting companies. Both product kind could also be bought as both standalone or non-compulsory add-on protection for owners, rental, or rental insurance coverage insurance policies.

The IC3 says it receives about 2,412 complaints every day, however many extra cybercrimes probably go unreported for numerous causes. Complaints tracked over the previous 5 years have impacted no less than 8 million folks. The 2023 Information Breach Report, which particulars the bigger dataset of cyber crime complaints to the FBI’s Id Theft Useful resource Middle (ITRC), reveals that final yr delivered a bumper crop of cybersecurity failures – 3,205 publicly reported knowledge compromises, impacting an estimated 353,027,892 people.

A brand new dialog about private cyber insurance coverage begins.

Triple-I and HSB are teaming as much as uncover methods to reinforce assist and sources for insurance coverage brokers whereas enhancing private cyber insurance coverage choices for policyholders. In case you are an agent, please take three minutes to assist by taking part in our survey. Your contribution will probably be invaluable in shaping the way forward for private cyber insurance coverage.