Even because the Smokehouse Creek Fireplace – the biggest wildfire ever to burn throughout Texas – was declared “practically contained” this week, the Texas A&M Service warned that circumstances are such that the remaining blazes may unfold and much more would possibly escape.

“At the moment, the hearth setting will assist the potential for a number of, excessive influence, giant wildfires which are extremely resistant to regulate” within the Texas Panhandle, the service stated.

This yr’s historic Texas fires – just like the state’s 2021 anomalous winter storms, California’s latest flooding after years of drought, and a surge in insured losses as a consequence of extreme convective storms throughout the US – underscore the variability of climate-related perils and the necessity for insurers to have the ability to adapt their underwriting and pricing to mirror this dynamic setting. It additionally highlights the significance of utilizing superior information capabilities to assist threat managers higher perceive the sources and behaviors of those occasions with a purpose to predict and stop losses.

For instance, Whisker Labs – an organization whose superior sensor community helps monitor dwelling fireplace perils, in addition to monitoring faults within the U.S. energy grid – recorded about 50 such faults in Texas forward of the Smokehouse Creek fires.

Bob Marshall, Whisker Labs founder and chief govt, advised the Wall Road Journal that proof suggests Xcel Vitality’s gear was not sturdy sufficient to resist the sort of excessive climate the nation and world more and more face. Xcel – a significant utility with operations in Texas and different states — has acknowledged that its energy strains and gear “seem to have been concerned in an ignition of the Smokehouse Creek fireplace.”

“We all know from many latest wildfires that the implications of poor grid resilience will be catastrophic,” stated Marshall, noting that his firm’s sensor community recorded comparable malfunctions in Maui earlier than final yr’s lethal blaze that ripped throughout the city of Lahaina.

Function of presidency

Authorities has a crucial position to play in addressing the danger disaster. Modernizing constructing and land-use codes; revising statutes that facilitate fraud and authorized system abuse that drive up declare prices; investing in infrastructure to scale back expensive injury associated to storms – these and different avenues exist for state and federal authorities to assist catastrophe mitigation and resilience.

Too usually, nonetheless, the general public dialogue frames the present scenario as an “insurance coverage disaster” – complicated trigger with impact. Legislators, spurred by calls from their constituents for decrease premiums, usually suggest measures that might are inclined to worsen the issue as a result of they fail to mirror the significance of precisely valuing threat when pricing protection.

The federal “reinsurance” proposal put forth in January by U.S. Rep. Adam Schiff of California is a living proof. If enacted, it could dismantle the Nationwide Flood Insurance coverage Program (NFIP) and create a “catastrophic property loss reinsurance program” that, amongst different issues, would set protection thresholds and dictate score elements primarily based on enter from a board through which the insurance coverage business is barely nominally represented.

U.S. Rep. Maxine Waters (additionally of California) has proposed a Wildfire Insurance coverage Protection Research Act to analysis points round insurance coverage availability and affordability in wildfire-prone communities. Throughout Home Monetary Providers Committee deliberations, Waters in contrast present challenges in these communities to circumstances associated to flood threat that led to the institution of NFIP in 1968. She stated there’s a precedent for the federal authorities to step in when there’s a “non-public market failure.”

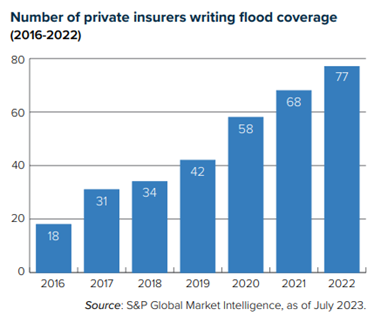

Nevertheless, flood threat in 1968 and wildfire threat in 2024 couldn’t be extra completely different. Earlier than FEMA established the NFIP, non-public insurers had been usually unwilling to underwrite flood threat as a result of the peril was thought of too unpredictable. The rise of subtle laptop modeling has since given non-public insurers a lot larger confidence masking flood (see chart).

In California, some insurers have begun rethinking their urge for food for writing householders insurance coverage – not as a result of wildfire losses make properties within the state uninsurable however as a result of coverage and regulatory selections revamped 30 years in the past have made it exhausting to jot down the protection profitably. Particularly, Proposition 103 and its regulatory implementation have blocked the usage of modeling to tell underwriting and pricing and restricted insurers’ capability to include reinsurance prices into their premium pricing.

California’s Insurance coverage Commissioner Ricardo Lara final yr introduced a Sustainable Insurance coverage Technique for the state that features permitting insurers to make use of forward-looking threat fashions that prioritize wildfire security and mitigation and embody reinsurance prices into their pricing. It’s cheap to count on that Lara’s modernization plan will result in insurers rising their enterprise within the state.

It’s comprehensible that California legislators are wanting to act on local weather threat, given their lengthy historical past with drought, fireplace, landslides and more moderen expertise with flooding as a consequence of “atmospheric rivers.” However it’s vital that any such measures be properly thought out and never exacerbate current issues.

Companions in resilience

Insurers have been addressing climate-related dangers for many years, utilizing superior information and analytical instruments to tell underwriting and pricing to make sure ample funds exist to pay claims. In addition they have a pure stake in predicting and stopping losses, fairly than simply persevering with to evaluate and pay for mounting claims.

As such, they’re perfect companions for companies, communities, governments, and nonprofits – anybody with a stake in local weather threat and resilience. Triple-I is engaged in quite a few tasks geared toward uniting various events on this effort. If you happen to symbolize a company that’s working to deal with the danger disaster and your efforts would profit from involvement with the insurance coverage business, we’d love to listen to from you. Please contact us with a short description of your work and the way the insurance coverage business would possibly assist.

Be taught Extra:

Triple-I “State of the Threat” Points Temporary: Wildfire

Triple-I “State of the Threat” Points Temporary: Flood

Triple-I “Traits and Insights” Points Temporary: California’s Threat Disaster

Triple-I “Traits and Insights” Points Temporary: Threat-Primarily based Pricing of Insurance coverage

Stemming a Rising Tide: How Insurers Can Shut the Flood Safety Hole

Tamping Down Wildfire Threats