A brand new report has revealed that Michigan has damaged its 7-year streak on the prime of the high-priced checklist.

Michigan has lengthy been the state through which the drivers have needed to face the most costly automotive insurance coverage premiums. Nevertheless, based on the outcomes of a brand new knowledge evaluation printed in a report by insure.com, that state has now slipped into second place and a brand new one has taken the pricey lead.

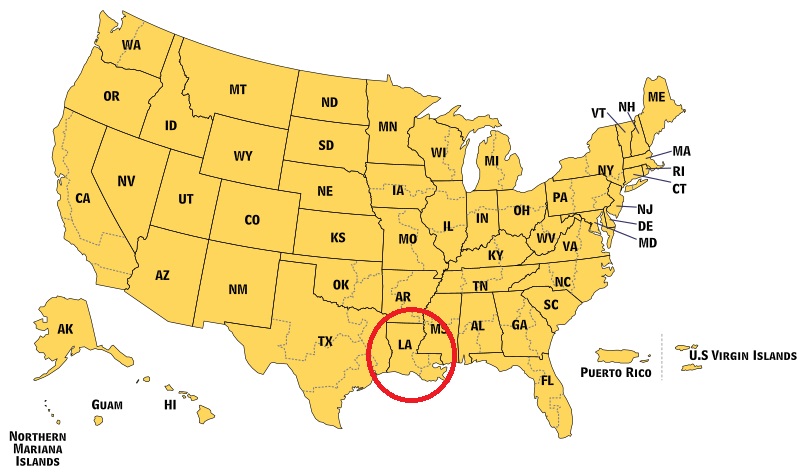

As Michigan has stepped down into second place, Louisiana drivers now discover themselves paying essentially the most.

Louisiana drivers now pay the most costly automotive insurance coverage charges within the nation. The report said that Louisiana’s common premiums are $2,839 per 12 months. That stated, Michigan is a a lot decrease $2,112, making it a transparent second to Louisiana’s a lot larger common charges.

“This report from insure.com provides to the mounting proof that no-fault reforms are working and saving Michigan drivers cash,” stated Insurance coverage Alliance of Michigan government director Erin McDonough, as quoted in a information launch. “There are nonetheless loads of Michiganders who haven’t renewed their auto insurance coverage for the reason that new regulation took impact, which suggests Michigan’s charges could possibly be even decrease by this time subsequent 12 months.”

Attributable to modifications within the Michigan system, its figures have fallen from the most costly automotive insurance coverage.

Final 12 months, the common premiums for auto insurance coverage fell by 27 p.c within the state. This was a mixture of the influence of the pandemic taking automobiles off the state’s roads, and substantial modifications that have been made to the state’s system. Total, it was the latter of these two points that diminished the charges being paid by drivers to the most important extent.

“Michigan makes use of a really distinctive no-fault system that has resulted in sky-high charges for years. Current modifications to their system are liable for their drop to second place this 12 months,” concluded the report.

The state had been battling with its most costly automotive insurance coverage charges for a few years, with lawmakers struggling to return to an settlement relating to the way to repair the problem. Whereas they unanimously agreed that one thing needed to be completed, it took years to develop an overhaul plan with sufficient help to move.

The state had been battling with its most costly automotive insurance coverage charges for a few years, with lawmakers struggling to return to an settlement relating to the way to repair the problem. Whereas they unanimously agreed that one thing needed to be completed, it took years to develop an overhaul plan with sufficient help to move.